What we do

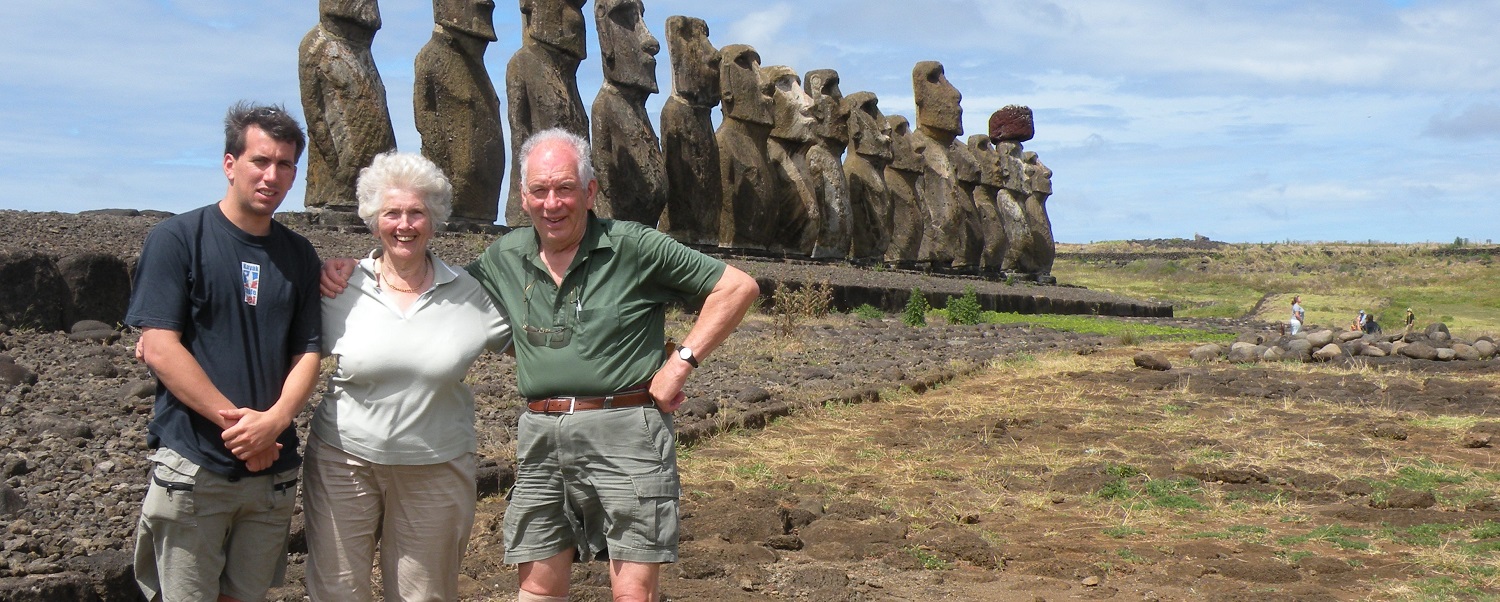

At BoulterBowen WealthCare, we take the worry from money for our clients, so they can have the time of their lives.

We build lasting relationships with our clients and their families, ensuring that their wealth is protected for the long term. We take the time to understand the visions of their futures, articulating what’s truly important to them.

Our clients’ concerns are universal: How do I maintain my lifestyle? What if I outlive my savings or make a mistake with them? How do I make the complex decisions I now face?…. And what about tax, inflation and other things beyond my control?

We have found that these concerns can lead to a condition we call Financial Paralysis, where the easiest thing to do is nothing at all.

We have developed a process called WealthCare to overcome these concerns, enabling us to take you from complexity to clarity.

WealthCare is a unique combination of: Financial Coaching- articulating what is truly important to you, Lifetime Cashflow Planning- helping you make long term decisions in a world of short term distractions, and Risk Management- to balance the risk you’re comfortable with against the risk you need to take.

WealthCare always starts with a question: ‘When we meet in a year’s time and look back to today, what must have happened for you to be happy with your progress?’

If you want to stop worrying and start living, contact James Bowen to find out more.

The value of investments may fluctuate in price or value and you may get back less than the amount originally invested. Past performance is not a guarantee of future performance.